What is personal finance and what does it mean to you?

Apr 8, 2024

When you search for information regarding personal finance you quickly get information regarding budgeting, investing, taxes, don't buy coffee on the go and that avocados are the devil's work. Some even tell you to just spend less than you make and you will be just fine. While all of this is good advice, except maybe to give some slack to the avocados, you need to always think in which stage in life you are and what are your priorities. When looking at the situation from the eyes of another person, life looks very different for an 18-year old starting their first job and living with their parents, than to an 35-year old parent of two living in their own house. One could argue that there is no difference if you are 18 or 35, money works the same way but the issue comes with the fact that money is just a tool, ways to spend it is as many as there are people spending it. So the question is, what is your goal and how to use this tool to achieve it? This is where it gets interesting. Let's take a look at some of the common concepts used in personal financing and how these could be possibly used in your situation. All of these concepts I will cover in much greater detail later on as separate topics but I want to make it clear that all of these areas depend so much on your current stage of life and the goals you have set. Let's go through some examples using a traditional journey one might take.

Budgeting

The B word, this brings out mixed feelings amongst us as it is quite often so that you either love it or see it as a total waste of time. You might have heard of people who state that they don't use a budget and are still able to do all “right” things with money. These people have very clear habits and are able to structure their spending in a very controlled way. This is not the case with most of us as keeping emotions and impulse buying under control is a constant battle without clear boundaries that a budget creates. Budgeting is a powerful tool and a necessity if you want to get your finances in order for most of us. I would like to argue that a budget is a tool that we can all benefit from, the difference comes on what do you use the budget for. It could be to get the initial understanding where money goes, need to restructure finances to be able to afford some larger purchase or to just have a constant overview of how finances are in general. All this comes again back to the question of which stage of life you are in and what are your goals.

First stage

First stage is usually from around 18-25 years old. You are able to start working at your first job, either part-time on the side of studies or already at your first full-time job. Might still live at your parents place or have some cheaper rental apartment where to spread your wings the first time. Your current goals are most likely to save for your first own apartment down payment or to upgrade to a nicer rental as the roommates are not quite what you want. Your budget should heavily be skewed towards saving as much as possible towards your goal. There are 2 exceptions that so many people forget that I am going to stress over and over again in this and the future posts..

Always include fun into the budget, NEVER BUDGET FUN OUT OF IT!

Start investing as soon as possible, never stop unless forced to.

Next make a fun budget, this might be going out for a few drinks with friends, going to movies or anything you are interested in. Even when you are using a budget and have a goal, never ever forget that you need to also live a life and enjoy it. This is why even with very clear goals, always leave some room for fun. There might be times when it is very limited but you have to allow it to yourself. Make sure you cover all your costs including variable costs like food etc, include estimates on how much you need to try to stick to it as close as possible. The amounts allocated should be enough that you can enjoy your life, but not so much that it makes saving and investing totally impossible. Rest of the money goes to saving and investing as much as you can afford.

Second stage

This is where life usually gets rather hectic. This stage, let's say, is from age 25-45. There is a word in Finnish language that sums up this time of life rather nicely, the word is ‘Ruuhkavuodet’, literal translation to english is traffic years. In practice, it means less sleep, less free time, less money, and less space, all while trying to build your career. This is usually the case due to having children and they change the pace of life a lot. Let's assume that you were able to save up a nice chunk during the first stage. You found yourself a partner, bought a house and have two kids running around in the house. The budget in the first stage had only a few rows technically, like: rent, food, gas, hobbies, misc.spending (clothes etc), fun, savings and investing. What happens during this stage usually is that the rows needed to actually understand where your money goes and are needed doubles, if not triples. Why this happens is because so many subcategories come into the mix that earlier were not needed to be worried about. The same list still applies as in the first stage, just change rent with mortgage but under hobbies comes few more participants, misc.spending goes to a totally new level as kids constantly grow out or break their clothes. The house becomes its own budget member as it always needs something to get fixed or “the colors don't quite work anymore..” types of situations. The point being that the same amount of money that you had before is now stretched into multiple additional categories and keeping up with it all requires quite a bit of effort.

We can assume that your income has increased and now that there are two working adults in the household the net income is also higher. This rarely gives you the freedom to use your money in a carefree way, quite the opposite, the amount of planning is high and constant. As with all the additional rows in the budget, you cannot forget about fun and investing. They take their own part of the cake that is shared with all the other expenses. Hence, traffic years, less of everything and the time where a budget is your best friend to navigate through these times so that won't crash and burn financially or mentally from financial stress.

Third stage

This is where life usually calms down a bit as kids are flying out of the nest, you do not worry so much about life and the small things do not keep you awake during the night. Budgeting also becomes a bit simpler again as you have less obligations to think about. Let's assume that you are both still working and income has increased with a steady pace over the years. This means that the budget has suddenly a lot more wiggle room and it is heavily skewed towards savings and investing currently. The house is starting to be old though and needs a lot of fixing so that part needs extra attention. It might be you keep a larger sum as cash so that you have liquidity to help out the kids if they end up in a pickle or want to spoil the possible grandkids with a small trip. Your focus is mainly targeted towards retirement time when income will decrease and will have to make by with less. You decide to invest into a summer cottage where the whole family can be together and enjoy the summer days together. Maybe the old house is also too large for just the two of you so decide to downsize in the end after debating the idea for a few years. In general your savings and investments are growing, have more time at your hands to pick up new hobbies and travel to places you didn't manage to visit before that you always wanted.

As you can see that this hypothetical journey of budgeting varies between the stage you are in a lot, what are your goals and even so, it includes a lot of if’s and but’s. Budgeting has to be looked at from the needs and wants of the person creating it. There are only 2 things that are always there, remember? Never budget fun out and never stop investing, unless forced and the last resort to do. Before you say that this is not always possible, yes, I agree, there are extreme situations when you cannot keep to this but these are the general rules that I want to point out currently.

Investing

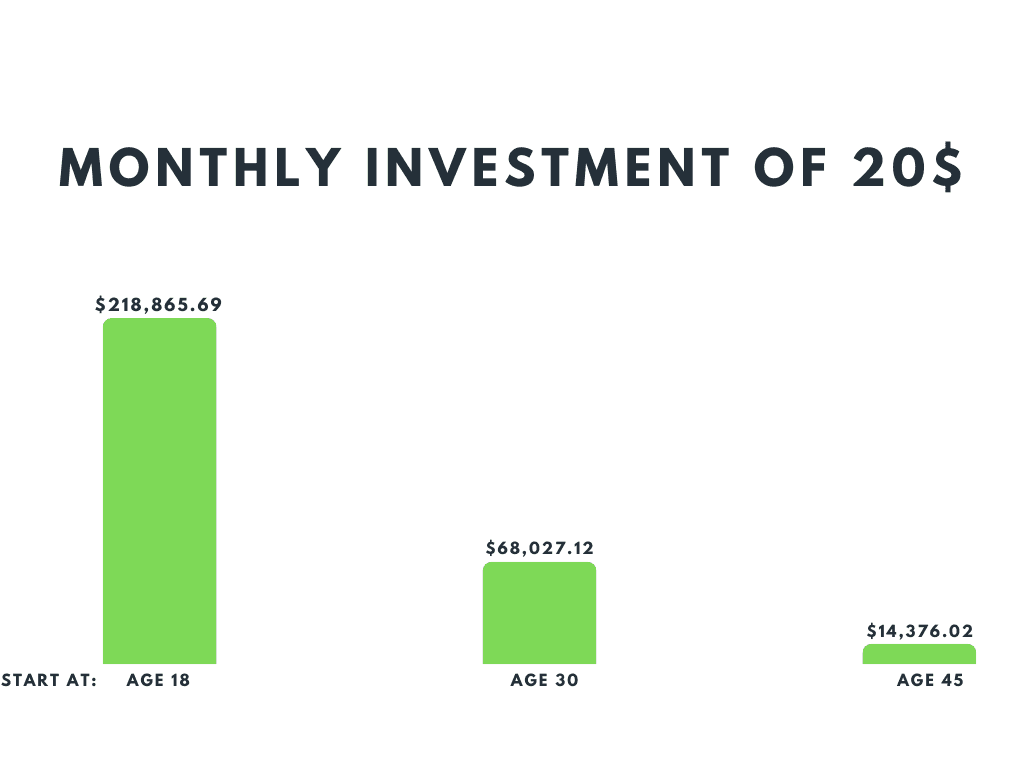

Let's look at the topic so that it supports the journey we took with budgeting. As mentioned already a few times this is an activity you should start as soon as possible and simply never stop. What this means is that the faster you start, regardless of the amount you invest, the faster your wealth will accumulate. This is due to something called compound interest, a term many of us have heard of but the actual power of it is often overlooked. Below you can see a graph showing the starting ages of investing 20$ per month, into an index fund that gives on average 10% annual return, compounded annually. The time frame is until the age of 65, from ages 18,30 and 45.

Let us break this down a bit more, during the time of 47 years it takes from the age of 18 to 65, contributing only 20$ monthly into an index fund that gives an average of 10% annual return becomes almost 220,000$. You know what is the beauty of this? Your contribution to this amount with 20$ deposits is 11,280$. You made almost 210,000$ of money “out of thin air” with the power of compounding or interest on interest effect. By starting 12 years later, at the age of 30, your income is more than 150,000$ or 70% less. This is how fast the compounding snowball starts to roll after a certain point. Let's have a look also if we would be investing 100$ per month during the same time frame.

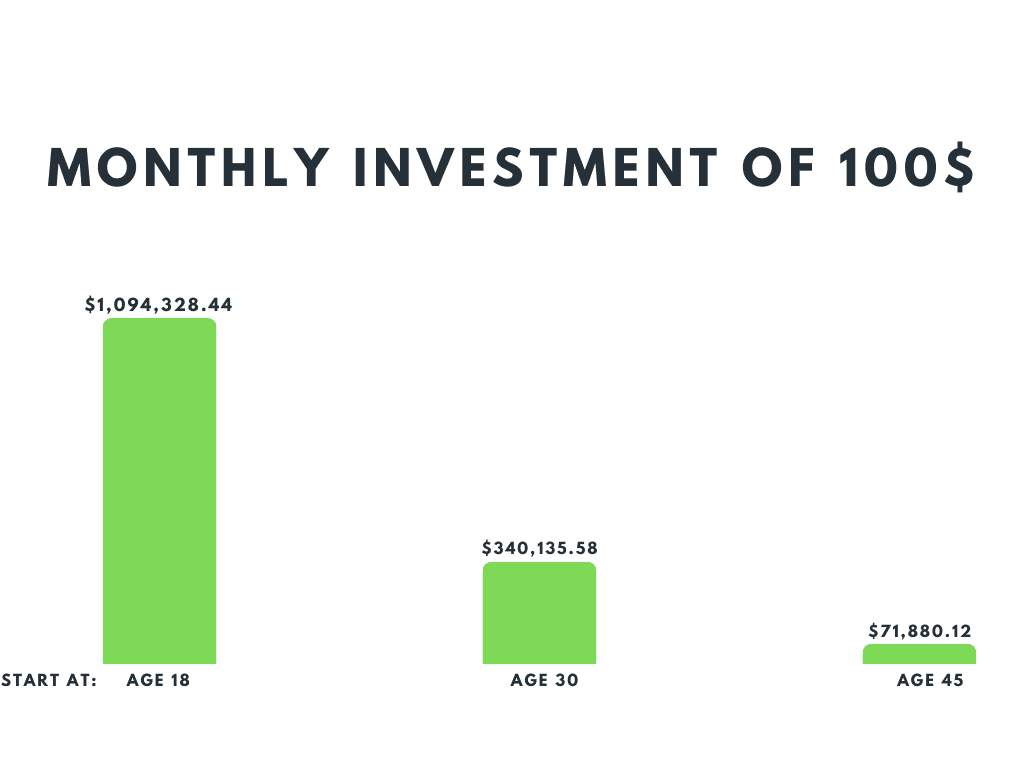

As you can quickly deduct from this is that all the numbers are just simply 5 times higher than in the previous picture. Why I wanted to show you this is that I just gave you the recipe to become a millionaire. It is this simple, there is no magic to it, just invest 100$ per month for 47 years straight and you will become a millionaire by the time you are 65 years of age. This is the reason why one of the main rules of budgeting is to start including investing into it as soon as possible and simply never stop. All you need is patience and time and you can become a millionaire if you just put some of the money to the side every month and simply forget it exists until you really need it. I will be going into much more detail regarding investing in later posts but hope this gives you some food for thought.

Savings

I want to make a few things clear regarding saving also that are not always that intuitive when it comes to personal finance. This is the most common concept people think about when you bring up the topic of personal finance. Putting some money on the side for a rainy day is usually the advice given for people, which is the totally correct way to approach this but let's take a look at this in a bit more detail. Savings should always be covering your living costs fully for a certain amount of time, this is usually called the emergency fund. If you are saving for something specific this should be added to this amount, meaning the emergency fund should stay intact and an additional amount for the goal you want to reach, let's say buy a new bike, should be put into the savings. Easiest way to look at this is that every item or action that you want to do that requires money should be budgeted as separate subcategories into savings. I have seen statements that “you do not need to save for something specific”, how I see this is that you always save for something specific, you never invest for something specific other than increasing long-term wealth. This way you can min/max the use of money and these stay as totally separate areas in your money management. There are of course investment tools that can be used for the savings to increase their value if saving for something larger like a summer cottage, as seen earlier that time and patience is your friend here.

So what is personal finance for you?

Now that we have seen some of the concepts regarding personal finance, are you able to answer the questions:

What does it mean to you?

What are your goals?

How do you want to achieve the goals?

These are not always that easy to answer and require some understanding of what are your goals and priorities. If these are not clear yet then just save and invest what you can as the priorities will come, trust me, life tends to have its way to decide these for us sooner or later. What I want to show and stress with this story is that personal finance is very individual, it's even stated in the name of the concept. Do not make decisions based on things you see or read what others are aiming for, make sure the goals you have are yours, as otherwise reaching these won't give you the reward you hope for. There are tools on how to achieve a healthy personal finance and if not sure how to use them, then help is just one contact away.